| Profile | Major Works | Resources |

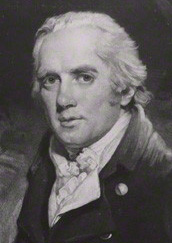

Henry Thornton, 1760-1815.

English banker, politician, philanthropist and and pioneering monetary economist.

An opponent of the Real Bills doctrine, later an eloquent defender of the Bullionist position and a fundamental figure in monetary theory. His process of monetary expansion anticipates Knut Wicksell's theory of the "cumulative process which restates the Quantity Theory in a theoretically coherent form. He is also sometimes characterized as proto-marginalist.

Henry Thornton was the third and youngest son of John Thornton, a wealthy London merchant engaged in the Russia trade. The Thorntons originally hailed from Hull, Yorkshire. Henry's grandfather, Robert Thornton, and his brother Godfrey, had moved to London in the early 18th C. to enter the Baltic and Russia trade. They both had made fortunes and become Bank of England directors. Robert settled the family in Clapham. In the 1750s, a local Clapham curate Henry Venn (grandfather of the mathematician) converted Robert's son, John Thornton, to the Wesleyan wing of the Anglican Church. John Thornton's Methodist leanings and munificence towards evangelical causes and charities of multiple stripes would have a profound influence on his son Henry. Henry formed an early attachment with his cousin William Wilberforce (who grew up partly in the Thornton home) and the two would later go on to form the core of the "Clapham Sect" of Christian social reformers.

Perhaps reflective of his parents' unorthodoxy, Henry's education had been a little spotty - after eight years of solid education at Wandsworth, Henry was transferred at the age of thirteen to a rather more experimental school run single-handedly by a certain Mr. Roberts in Point Pleasant. Henry would later characterize it as an underwhelming experience, that he received "next to no education".

In 1778, at the age of eighteen, Henry was apprenticed in the counting house of his relative Godfrey Thornton (son of the elder Godfrey), and in 1780 moved into his own father's trading firm, Thornton, Cornhill & Co. Finding his father's trading practices rather nebulous and speculative, Henry Thornton gave up the merchant's life and, over his parents' objections, pursued a more reliable banking career. He joined the banking house of Down and Free on Bartholomew Lane in 1784, where he would soon make partner (becoming Down, Thornton and Free). He would remain with this bank for the remainder of his life.

Parallel to his banking activities, Thornton also launched into a political career. In 1780, at his mother's urging, Thornton stood for a seat in Hull, but pulled out when he realized he was expected to bribe voters. He ran again in 1782 in Southwark, London, and won. Although a populous borough, Henry Thornton managed to remain M.P. for Southwark until the end of his life, three decades later, winning eight straight contested elections. Henry later recalled his first vote in parliament was for peace with America.

In parliament, Henry Thornton charted an independent liberal course, fluctuating between Fox's Whigs and Pitt's Tory faction (Wilberforce, also an MP, was more loyally attached to Pitt). In 1792, after his father's death, Henry Thornton bought an estate on Battersea Rise, Clapham, and leased one of its houses to Wilberforce. Another tenant was Edward James Eliot, the brother-in-law of Pitt (it is reported that Pitt spent many a sojourn there himself). The Clapham Sect, or "party of saints" (as it was derisively called) began to take shape there, in the living rooms of Thornton and Wilberforce. Thornton was the leading supporter of Wilberforce's anti-slave trade agitation, from its beginnings in 1787 to its culmination in 1807. Thornton himself was a founder and chairman of the Sierra Leone Company, that established a colony for freed slaves in West Africa in 1787. Lending his financial expertise, Thornton served as treasurer for a variety of other Clapham-related schemes, such as the Society for Missions to Africa and the East (f. 1799), the British and Foreign Bible Society (f.1804), the African Institution (f.1807)

Thornton's parliamentary voting record in the 1790s finds him repeatedly in support of peace with the French Republic, in favor of parliamentary reform, Catholic emancipation and Pitt's income tax. He carved out a reputation in parliament as an expert in financial matters.

Thornton's greatest performance was doubtlessly his 1802 Enquiry on Paper Credit, his seminal contribution to the Bullionist controversy. Parliament had suspended convertibility of Bank of England banknotes to gold in 1797. In 1801, Walter Boyd sensationally blamed a recent bout of inflation and a decline in the exchange rate for the pound on excessive note issue by an unanchored Bank of England. Henry's older brother, Samuel Thornton, was the governor of the Bank of England at the time, and Henry may have felt a fraternal obligation to defend the Bank's honor. Thornton wrote his Enquiry in response to Boyd, showing that while Boyd's theoretical point had merit, it did not translated into facts in this case as there was no excess issue. The inflation and the depreciation of the paper pound was due primarily to war-related payments abroad, failed harvests and wartime difficulties in the importation of corn. Francis Horner favorably reviewed Thornton's treatise in the very first issue of the Edinburgh Review, helping popularize its thesis. Thornton's views seemed vindicated when the pound subsequently rose in the aftermath of the peace of Amiens.

It was not in the facts he outlined, but in the construction of monetary theory that Thornton's contribution is usually celebrated. He debunked the Real Bills doctrine, and upheld the Quantity Theory of money, albeit more thoroughly and carefully than his predecessors. Thornton explained the process of monetary expansion in detail, how it worked through the banking sector, and business borrowing, and affected the economy. In many ways, Thornton anticipates Knut Wicksell's theory of the "cumulative process", which restates the Quantity Theory in a theoretically coherent form. As his work makes dexterous use of supply-and-demand arguments, Thornton is also sometimes characterized as a proto-marginalist.

A few years later, Henry Thornton, along with Horner, was appointed to the 1810 Bullion Committee, to address the matter of resumption again, which had been revived by Ricardo. Thornton had a hand in the writing of the committee's report, and this time he retreated from his prior anti-bullionist position and recommended resumption of convertibility, albeit warning that it should be done at the depreciated rate, to avoid deflationary effects on the economy.

|

|

|

HET

|

|

Resources on Henry Thornton

|

All rights reserved, Gonšalo L. Fonseca