| Profile | Major Works | Resources |

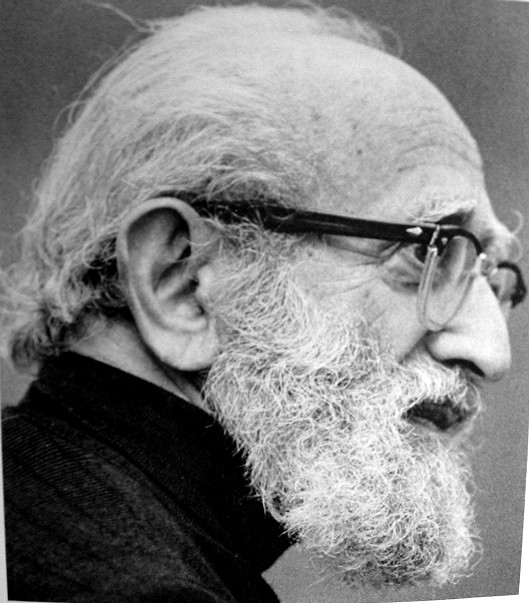

Abba P. Lerner, 1903-1982.

![]()

Abba P. Lerner was born in Russia, raised on the London East End and worked as a

machinist, a capmaker,

a Hebrew teacher, a Rabbinical student and tried his hand at business before enrolling

in 1929 at

the London School of Economics. It was his early

association with the plethora of socialist movements prevalent in the 1920s Britain that

brought him into contact with economics. The L.S.E. attracted the self-taught Lerner

largely because of its Fabian associations, but found

himself instead in the hands of Lionel Robbins.

Lerner's student career -- undergraduate and graduate -- was sheer brilliance. He published several first-rank papers in economic theory and still found time to launch the Review of Economic Studies with Paul Sweezy and Ursula Webb. His "student" papers catapulted him into the frontlines of the "Paretian revival" of the 1930s which consolidated Neoclassical theory. A six-month stint at Cambridge in 1934-5 brought him into contact with John Maynard Keynes's "Circus". Lerner subsequently became perhaps the first economist outside that charmed inner circle to truly grasp the meaning of Keynes's General Theory and, as a result, became also one of the leading pioneers of the Keynesian Revolution. Lerner moved to the United States in 1937, but was never really able to find a home. The footloose Lerner taught at over a half-dozen universities in his career, including, during the 1940s, the New School for Social Research.

Abba Lerner's numerous contributions to economic theory and policy make him one of most influential economists of the century -- although his congenital inability to play academic politics ensured that he would not lead a conventional career. His initial contributions, published while he still was a student, were in international trade theory and general equilibrium theory. His 1932 article brought together the Haberler's production possibilities frontier, Marshall's offer curves and Pareto's indifference curves into a two-sector model for international trade. This was followed up in 1934 and have formed the basic way of presenting international trade theory since. Also in 1934, Lerner discovered the "factor price equalization" theorem, later rediscovered by Samuelson in 1948, albeit he left it unpublished until 1952. His 1936 paper proved the old intuition on the symmetry of export and import taxes.

In 1934, Lerner provided one of his most remarkable papers laying out the full Pareto-optimality conditions in a general equilibrium production economy - in particular, introducing that all-important Paretian rule for efficiency, i.e. that price equal marginal cost, P = MC. It was here too that Lerner presented the idea of "degree of monopoly" as being captured by the extent of deviation of price from marginal cost.

Partly as a result of this major contribution to Paretian theory, he joined Oskar Lange in the "Socialist Calculation" debate (1934, 1935, 1936, 1937, 1938, 1944). Lerner stressed the importance of achieving efficiency by the P = MC rule, and that these could be achieved by socialism or free markets. He stressed that as a result, only the initial distribution of income is at the discretion of the social planner, the resulting allocation can only be as efficient as in a perfectly competitive market economy. Lerner was convinced of the beauty and efficiency of the Paretian general equilibrium system - but sober enough to realize that it was an idealization and rarely attained - thus, the case for socialism. However, he was not too doctrinaire about it: Lerner believed in economic democracy, the importance of consumer choice, and argued that private enterprise should take over any particular industry in a socialist economy if it proved to be more efficient.

Lerner was opposed to waste - misallocation of resources was waste, but a far greater waste was unemployment. In 1936, Lerner wrote one of the first and most remarkable review of Keynes's General Theory, providing a remarkable closure to Keynes's system which he took up again later in 1939 and 1952. His analysis of investment and savings in Keynes (1937, 1938, 1939, 1944) were elucidating, particularly in solving the liquidity preference-loanable funds debate then raging and advancing the theory of investment considerably by clarifying the concept of user cost of capital and showing the relationship between the marginal productivity of capital and the marginal efficiency of investment (1936-7, 1943, 1953).

Perhaps of greater lasting impact was his development of the principles of "functional finance" (1941, 1943, 1944, 1948, 1951, 1961, 1973), which argued that government policy should be designed to obtain full employment output and price stability regardless of whether it increased or decreased public debt. He was an effective debunker of the the idea of the "burden of the debt" and "crowding out" arguments commonly used against deficit spending. Lerner's propositions initially shocked even John Maynard Keynes himself - although he eventually embraced them fully. As Keynes wrote, "[Lerner's] argument is impeccable, but heaven help anyone who tries [to] put it across to the plain man at this stage of the evolution of our ideas." (Keynes to Meade, April 1943).

His work on trade, welfare, socialism and Keynesian theory culminated in his magnum opus, The Economics of Control (1944). The older themes were integrated and laid out afresh - particularly the efficiency rules and his principles of functional finance. In this book, new ideas were broached: he introduced the idea of counter-speculation in foreign exchange markets as government policy combined with flexible exchange rates, the "Marshall-Lerner" conditions for stability in international trade, the idea of an "optimal currency area" and, perhaps most famously, his "optimal distribution of income", which made use of the "equal ignorance" assumption to argue that equal distribution of income is optimal - a proposition which led to a dispute with Milton Friedman.

From 1944 on, Lerner began to move away from pure economic theory and towards economic policy. A few exceptions must be mentioned - notably, the 1952 paper on the closure of Keynes's theory and an attempt at a remarkable "synthesis" of microeconomics and macroeconomics in a bold 1962 paper. Another major exception was his remarkable work on inflation. Lerner was perhaps the first to recognize the importance of accounting for inflation in Neo-Keynesian theory and laid out his analysis in a remarkable series of articles and books (1944, 1947, 1949, 1951, 1972). In particular, he introduced the concept of "seller's inflation", a generalized form of "cost-push" inflation which was to become central to Sidney Weintraub and Post Keynesian economics. In his analysis of inflation, Lerner was quite ahead of his time: he recognized the possibility of stagflation, the unemployment-inflation trade-off of the Phillips Curve, what he called "high full employment" (a predecessor of the Friedman's natural rate of unemployment), the differential effects of expected and unexpected inflation and the theory of implicit contracts long before any of these concepts were discussed elsewhere.

Lerner was bubbling over in novel policy proposals. For instance, his analysis of inflation led to an early advocacy of incomes policies (1947) and, later, his remarkable "Market Anti-Inflation Plan" (MAP, 1980). Heuristically, MAP proposes to "internalize" the costs of inflation by setting up a type of voucher system whereby a firm obtains a surplus voucher to increase sales if sales in that year fall before a particular aggregate target, while a firm whose sales growth exceeds the target will incur a deficit voucher. The rattlesnake juice comes with the market part of it: if a firm wishes to raise sales above target regardless, then it can buy surplus vouchers on the open market from firms who are selling below target. This extension of the marketplace to the very process of inflation, Lerner argued, would not only internalize the externalities of inflation but also be an effective way of controlling aggregate demand without losing the individual dynamism of entrepreneurial activity.

As can be gathered from this (partial) list of contributions, it is shameful that an economist who contributed so much to the arsenal of economics should nonetheless have been condemned to roam in the professional underground. Any one of his contributions should easily have earned him a Nobel Prize, and the sum total of them earned him the recognition as one of the most remarkable economists of the century. But to the staid professionals of academia, Lerner was simply not "one of us": he must have struck a Bohemian impression: a peripatetic, bearded academic with open-toed sandals, open collars, and a penchant for mobiles who once went to Mexico to convince Leon Trotsky of the fundamental changes that had to be made to his doctrines in light of the Keynesian Revolution. However poor a salesman, Lerner was a sharp and relentless logician, highly creative in both his theoretical and policy analysis. He treated economics as an art form and was certainly one of the greatest masters of it.

|

Major works of Abba P. Lerner

|

HET

|

|

Resources on Abba P. Lerner

|

All rights reserved, Gonšalo L. Fonseca